Russian printing market 2022

Market Structure, Industry Trends, Equipment Situation

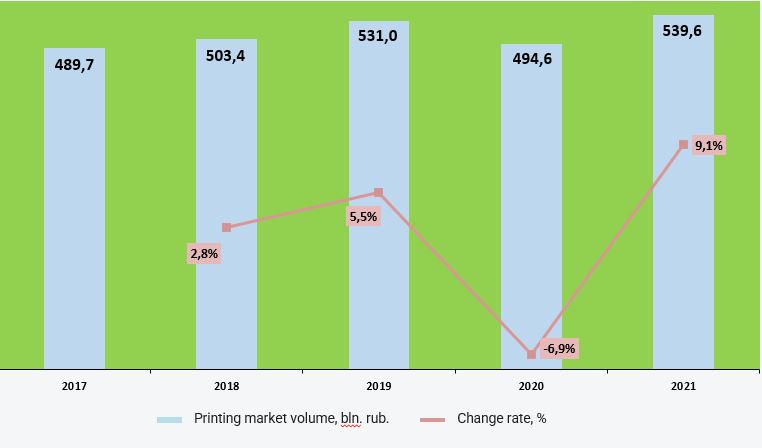

The printing industry is having tough times now. Although 2021 turned out to be quite successful: the volume of orders increased not only compared to 2020, but even compared to 2019. The increase in the cost of paper and cardboard has produced the major impact on the market growth. According to GuideMarket, by the end of 2021 the printing market volume amounted to RUB 539.6 bln, which exceeded the pre-crisis values of 2019 by 1.6%.

Despite the pandemic and political circumstances, the Russian printing market has shown positive dynamics.

The Russian publishing and printing complex includes various areas of print production: print media, book publishing, print advertising, packaging, digital printing. The Russian printing market is divided into segments focused on different groups of consumers, and includes both state unitary enterprises and private printing houses.

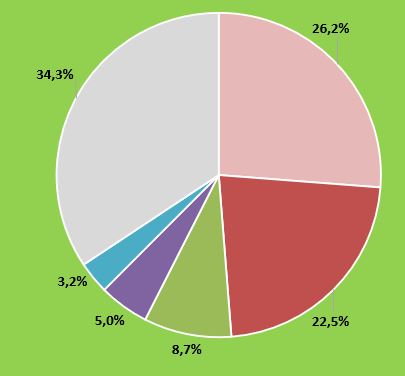

Printing Market Structure in 2021

(source: Rosstat)

26,2 % — industrial and technical product printing services 22,5 % — tag and label printing services 8,7 % — services for the printing of books, maps, replications, drawings and photographs, postcards 5,0 % — newspaper printing services 3,2 % — services for the printing of magazines and periodicals published less than four times a week 34,3 % — other printing services

Russian Printing Market Geography in 2021

(source: Federal Tax Service)

- 39.6% Central Region (24.4% of the industry companies are located in Moscow)

- 16,7% Volga Region

- 13,8% North-Western Region

- 10,7% Siberian Region

- 7,8% Ural Region

- 6,3% Southern Region

- 3,5% Far Eastern Region

- 1,6% North Caucasian Region

Market Drivers

Business preservation is the main objective of printing houses, but its solution depends on external conditions. The industry is affected by various economic, social, technological, political factors.

Negative Factors

- Economic factors: forecast GDP decline, currency instability, advertising print market behaviour

- Technological factors: high import dependency, digitalisation (+-)

- Social factors: population decline, drop in personal income

Positive Factors

- Political factors: state support, exemption of printing inks from excise duty

- Technological factors: robotisation and automation, digitalisation (+-)

- Social factors: stable audience of readers

Definitely, macro-factors produce a more negative impact on the development of the printing market. However some of them are not so unambiguous. For example, as part of the survey held by the Russian Public Opinion Research Center 45% of Russian citizens reported that they visit bookstores less than once a year or not at all. However, this does not imply that reading and, accordingly, buying books have declined: firstly, digital reading has appeared (a negative trend for printing industry), secondly, many people buy books via the Internet (a positive trend for printing industry), and book publishers are actively entering new sales channels and working with marketplaces.

High Import Dependency as the Key Problem

The import dependency of the domestic printing industry was the key problem of the industry even before the sanctions. The current crisis, of course, has aggravated it. The EU has imposed a ban on the supply of printing inks, uncoated and coated paper, cardboard, cellulose and paper or cardboard finishing equipment, as well as bookbinding machines, flexography, offset, high and gravure printing equipment to Russia.

Nowadays, companies are actively trying to establish parallel imports, although it is still prohibited to import spare parts and components for printing equipment. The companies are also switching to domestic paper in order to reduce the import dependency. Nevertheless, the cost of books has increased by 30% since the beginning of the year due to the shortage of paper and printing capacity.

State Support as a Positive Factor

Every year, the state allocates budgetary funds to support socially important projects relating to printed products, periodicals and books. For example, in 2022, the list of recipients of subsidies included publications in the national languages of the peoples of Russia, newspapers and magazines for children and youth, publications for pensioners and veterans, popular science, literary and cultural magazines, as well as federal and regional newspapers. The total budget for the support of socially important projects relating to print media in 2022 amounted to RUB 500.5 mln.

Exemption of Printing Inks from Excise Duty

In 2022, a bill excluding alcohol-containing printing inks from the list of excisable goods was introduced in the House of Parliament. The bill provides for obtaining a certificate for the production of alcohol-containing printing inks including a methylated spirit as their original material. The Russian government supported the bill.

Equipment Market Status

After the US printer manufacturers left Russia, Chinese, Japanese and domestic brands increased their shares in the Russian market. According to ITResearch, by Q3 end the Chinese company Pantum occupied 53% of the domestic printer market, although at the end of the previous year it had less than 20%.

HP, Xerox, Canon, Epson and several other foreign printer manufacturers announced suspension of their business in Russia in March. The share of the US player, HP, has decreased from 36% to 21% during this time, while Japanese Epson, Canon and Brother shares have halved.

The new suppliers include Taiwanese Avision, Chinese Huawei and Deli Group, as well as the South Korean brand Sindoh. There is a growing interest in the products of Russian manufacturers F+ imaging and Katyusha.

Printing Market Trends

Print volumes are falling, and the industry future is uncertain, since media consumption is unstable, and certain types of printed products have a short life cycle.

- The printing business margin is decreasing and, as a result, the chances of attracting external financial resources for the development of production are limited.

- Domestic printing production remains almost completely import-dependent.

- The cost of production is growing, as prices for all components of printing production - from printing paper to ink and chemical reagents - are rising.

- The printing market is losing the volume of orders due to withdrawal of foreign trademarks from Russia and problems with translated content, which accounted for a significant volume of output from a number of publishers.

- Foreign manufacturers of printing equipment refuse to import machine parts to Russia, as well as refuse to provide troubleshooting services.

Largest Players of the Printing Market

Nowadays, more than 20 thousand market entities are represented in the Russian printing market. Large and medium enterprises are offset, flexographic and digital printing houses; there are also small enterprises that are equipped with modern printing equipment.

Largest Players of the Printing Market in 2021:

- Goznak (paper products, protected printing, forms of documents) with 8.8% market share,

- Eksmo Publishing House (books and brochures) with 2.2% market share,

- MM POF packaging (labels and packaging) with 1.3% market share,

- Polygraph-Flexo (labels and packaging) with 0.9% market share,

- Pervaya Obraztsovaya Tipografiya (books and brochures) with 0.8% market share.

The other companies account for 85.9%, which indicates a very high degree of market fragmentation.

Printing Market Potential (Forecast until 2026)

The printing market undergoes the maturity stage being very close to the stage of decline. The level of competition in the market is maximum, which causes a more aggressive struggle for existing buyers against declining growth rates.

According to GuideMarket’s estimates for 2022, the market will shrink by 6.7% in view of the consequences of the special military operation, including a reduction in orders. In 2023-2026, the market will grow by an average of 3.3% annually. By the end of 2026, the total volume of the printing market may grow to RUB 572.0 bln.

The GuideMarket’s analysts estimate the market potential at 20% plus to the existing volume mainly due to price increases. However, no potential capacity is thought to be achieved over the medium term due to personal income decline and increased popularity of the online format.

The external conditions for the Russian economy remain to be difficult. The main feature of the current economic situation is that supply is shrinking more than demand. This produces inflationary pressure.

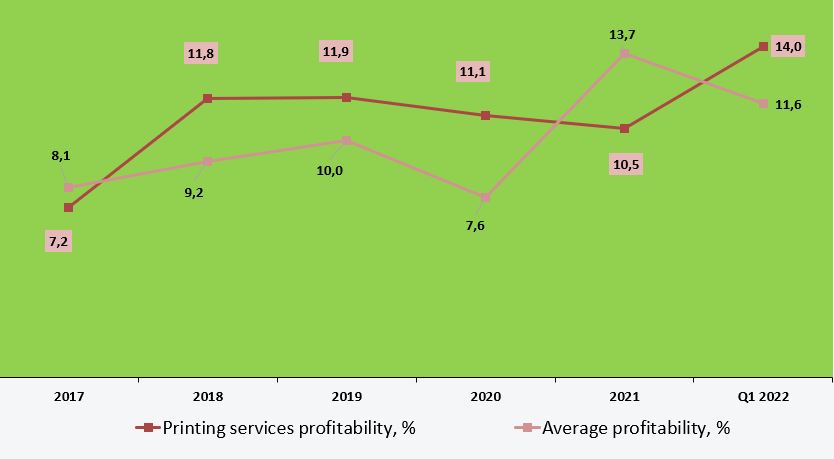

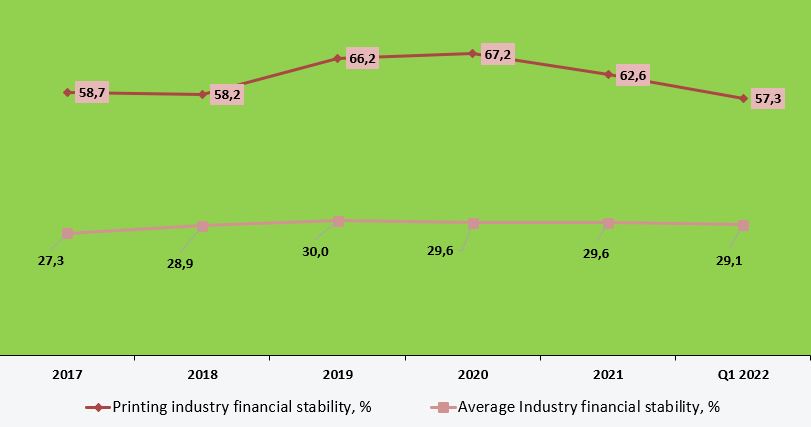

The profitability level of printing industry as compared to other industries (positive trend)

In financial terms, printing industry seems to be more stable compared to the national average indices (financial stability is the share of equity in the total working capital).

Factors to Affect the Market Behaviour in the Near Future

In addition to the current market trends described at the beginning of the article, the factors that will affect the situation will be as follows:

- significant increase in the cost of published products;

- development of information, digital and mobile technologies;

- general unfavourable macroeconomic conditions in the country;

- growth of demand for label, packaging products and tags.

Actions to Be Taken by the Companies in This Context

- to arrange supplies of printing consumables from other countries instead of European ones;

- to revive production and organise production of a fundamentally new range of printed products;

- to develop demand and expand the range of printing services;

- to upgrade printing processes to improve consumer properties of printed products;

- to take an active part in business development of their clients;

- to show new technological capabilities of production and additional services;

- to expand sales geography;

- to create innovative products;

- to promote diversification of existing production facilities.

An effective strategy to be adopted by small enterprises against the market decline consists in specializing in a specific market niche. This will allow avoiding direct competition and confrontation with the segment leaders. In future, intense reduction of import dependency, as well as the search for a balance between supply and demand will be the key drivers of the printing market recovery.

In the context of declining incomes, the value of competent marketing measures becomes higher for printing houses than technological innovations. It is necessary to encourage the existing customers to systematically or more frequently purchase the services, to carry out automated acceptance of web-to-print orders, to provide remote access and print-on-demand.

In global terms, the problem of qualified personnel shortage should be solved by building partnerships with educational institutions, developing targeted training programs, interacting with the state on measures to support Russian printing enterprises and combining efforts with other market players. Only collaboration can become a growth driver for the printing industry under the sanction pressure.

Sources: GuideMarket, RBK